doordash quarterly taxes reddit

This means if you made 5000 during 2021 for DoorDash your tax. However if you are self-employed ie.

Doordash Taxes Does Doordash Take Out Taxes How They Work

What are the quarterly taxes for grubhub doordash uber eats delivery drivers.

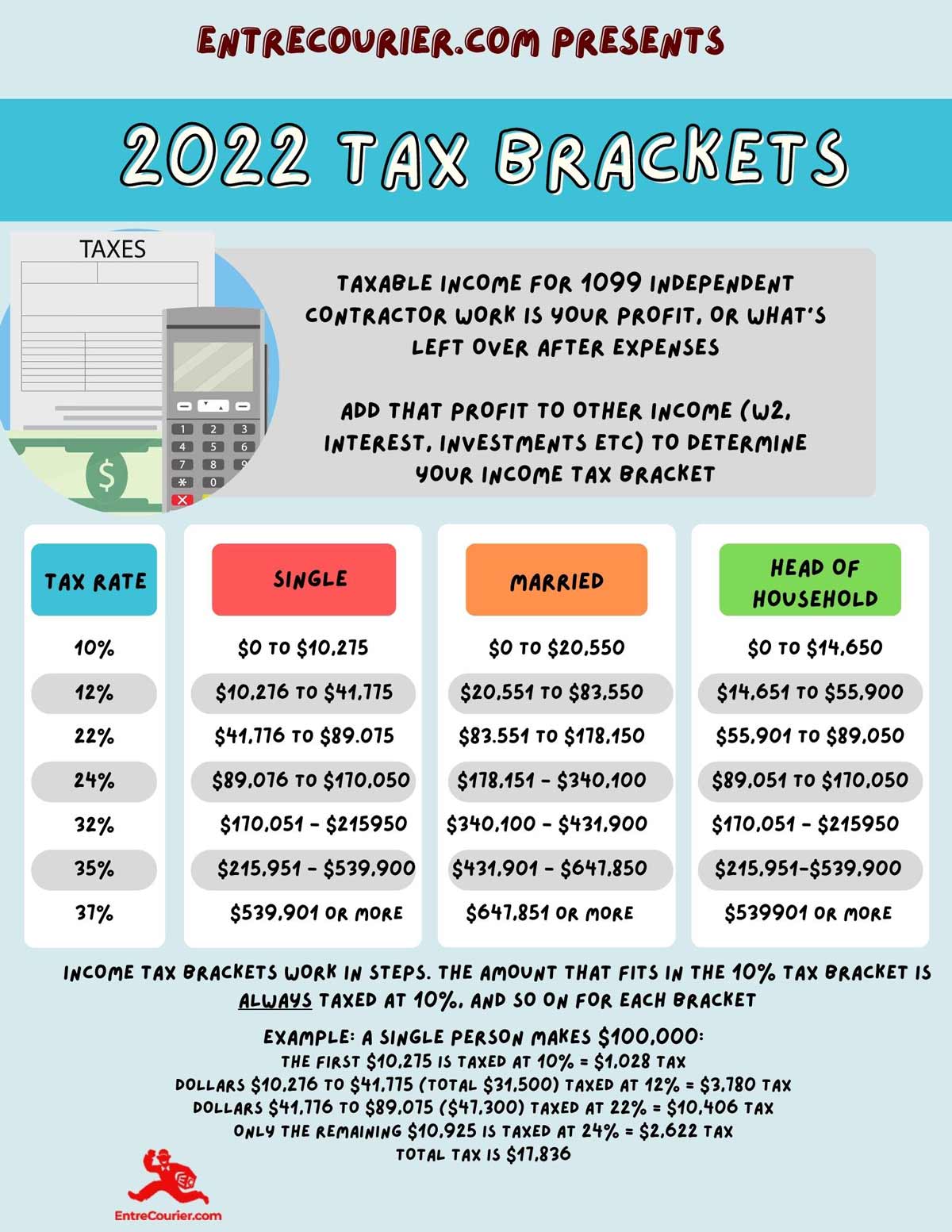

. Generally you should set aside 30-40 of your income to cover both federal and state taxes. Try the App Get the best DoorDash experience with live order tracking. Remember you will also need to pay State taxes unless you live in a 0 income tax rate state like Nevada.

There is no additional quarterly tax for Doordash delivery drivers. Traditional W-2 employees usually dont owe quarterly taxes because taxes are withheld from their pay. Whether you file your taxes quarterly or annually you need to set aside a portion of.

DoorDash does not automatically withhold. Thats your business income. Up to 12 cash back At DoorDash we promise to treat your data with respect and will not share your information with any third party.

However if you deliver for Doordash you may need to make. Since you are filing as self-employed you are liable for a 153 rate. This should be an easy fraction to compute and cover you unless you start earning more than 4000 per quarter.

This also means that you are responsible for reporting and paying income tax as well as self-employment tax. The term quarterly taxes causes some confusion. For example 10000 miles is 5800.

Youll get a W2 from your 40 hour and a 1099 from doordash. Paying quarterly taxes - workers. If you are expecting to owe 1000 or more on your return you are required to.

How much do you pay in taxes if you do DoorDash. DoorDash cannot provide you with tax advice nor can we verify the accuracy of any publicly available tax guidance online. Subtract that total from your earnings.

You can unsubscribe to any of the. Now multiply your miles times 58 cents for 2019 575 cents for 2020. You can pay online with.

Make quarterly payments of 15 of your net income.

Quarterly Tax Questions R Doordash Drivers

433 Startup Failure Post Mortems

Taxes Megathread Talk Taxes Here Only Here R Doordash

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

Pro Door Dasher Shares Tips To Maximize Your Earnings

How To Become A Doordash Driver Dasher Pay What To Expect Review

Top 5 Tax Loss Harvesting Tips Physician On Fire

Doordash Taxes And Doordash 1099 H R Block

Do Doordash Contractors Pay Quarterly Taxes Entrecourier

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

Tips For Filing Doordash Taxes Silver Tax Group

How Do Food Delivery Couriers Pay Taxes Get It Back

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Tips For Filing Doordash Taxes Silver Tax Group

Identifying Hidden Door Dash Tips In 2022 Finance Throttle

.png)